For those who may not know Binance as well, it’s one of the biggest crypto exchanges in the business and it handled approximately $23 trillion in trades in 2022. Previously, Binance also reportedly considered bailing out cryptocurrency exchange FTX when it declared bankruptcy amid its founder Sam Bankman-Fried’s legal troubles, though it ultimately decided against doing so. Remember, with Binance your assets are held at a custodian wallet (web wallet), i.e., your crypto is held in trust by the exchange. Like other digital assets available on the market, the value of BNB changes as people use and trade it. When using a privacy wallet like Wasabi Wallet, you are essentially using a Crypto Mixer with added privacy features decentralized. People who are looking for higher interest returns for their investment in a small time period will get this Bitcoin investment plan as their top bet. Computerized money related exchanges accompany a certifiable value: The colossal development of digital forms of money has made an exponential interest for processing influence.

/>

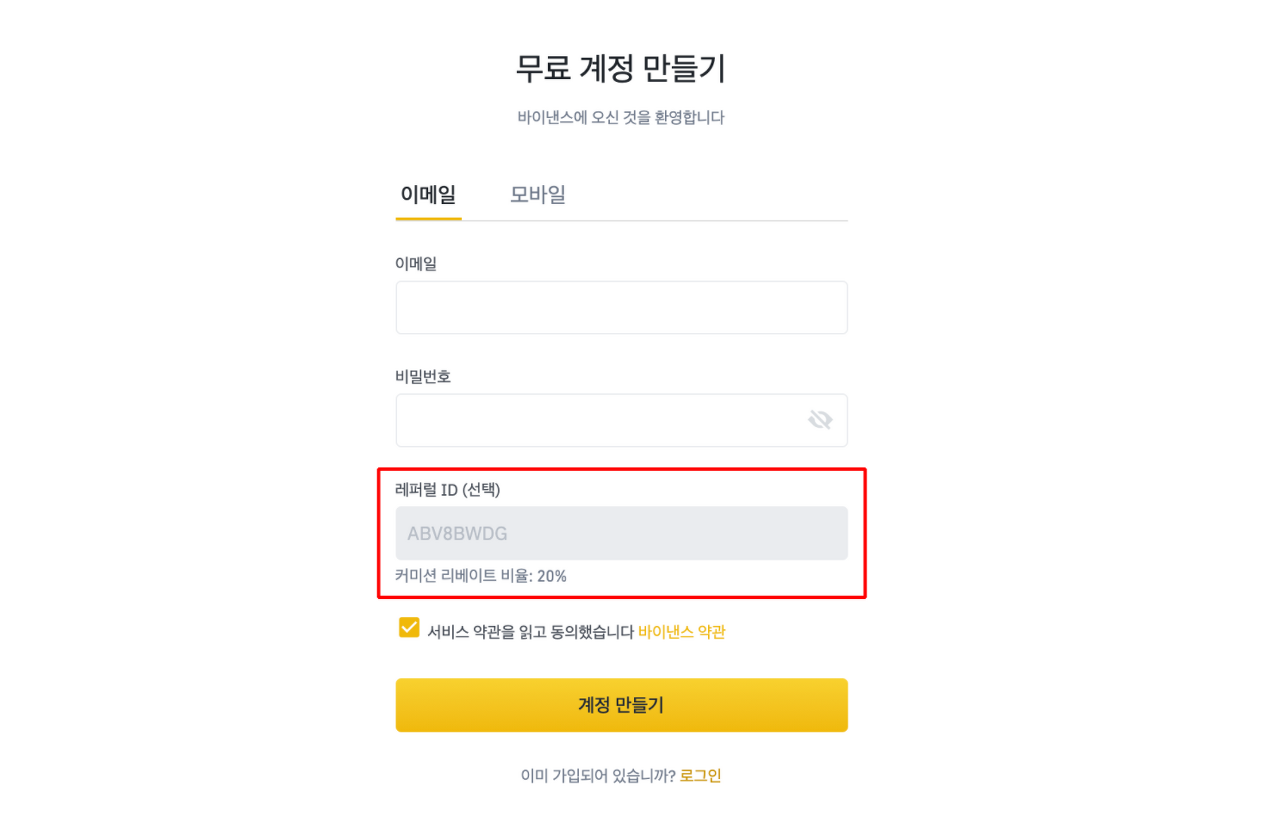

Cryptographic forms of money like bitcoin give an interesting administration: Monetary exchanges that don't expect governments to issue cash or banks to process installments. Toppling a tyrant like Bashir is a historical and incredible achievement. Nope. Even though I like to express strong opinions from time to time, I'm not a troll. Although multisignature escrow is a very interesting application in its own right, there is another, much larger issue that multisignature transactions can solve, and one that has been responsible for perhaps the largest share of Bitcoin's negative associations in the media, dwarfing even Silk Road, in the last three years. Needless to say those who have been in Bitcoin industry for some time know it fairly well that Bitcoin is precious than even gold. Those same individuals are presently understanding that in the event that they'd recently paid in real money and clutched their computerized cash, they'd now have enough cash to purchase a house. This would effectively give them control of the transaction ledger and allow them to spend the same bitcoins over and over again. The trick is to get all miners to agree on the same history of transactions. Senior 바이낸스 레퍼럴 bankers are discussing the potential of blockchain technology as a way to cut costs and improve transparency for financial transactions.